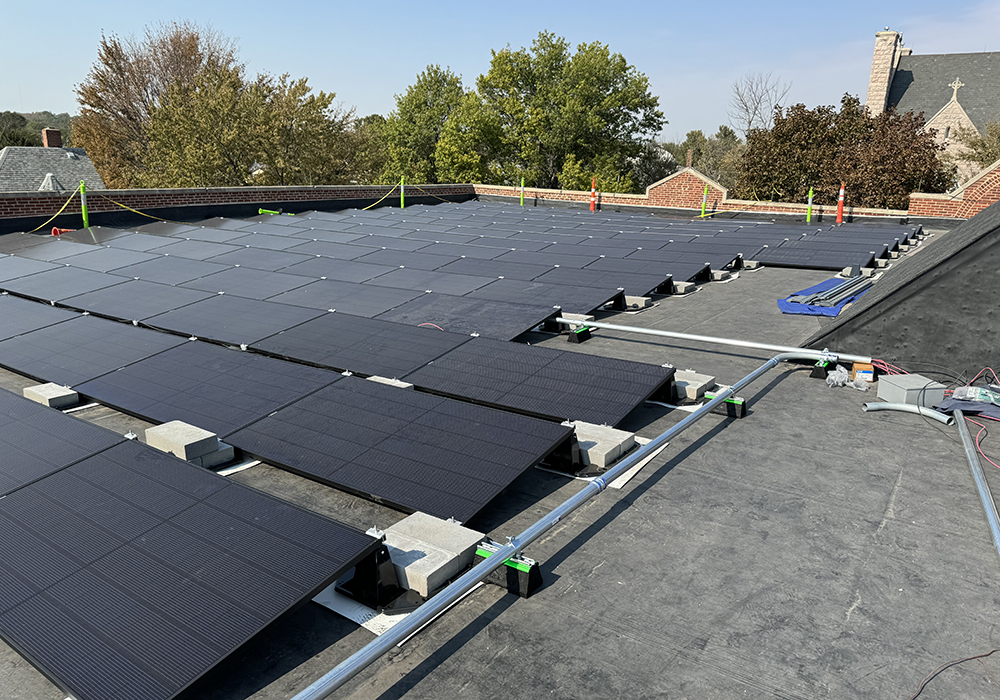

A 70-kilowatt solar array sits atop of Sacred Heart Catholic School, in Omaha. To help cover a portion of the costs, the Catholic school intends to apply for a federal clean energy tax credit. (Afton Energy)

Catholic parishes, schools and houses of worship across the country pursuing wind and solar projects were dealt a major financial blow in President Donald Trump's domestic-policy and tax-cut bill signed into law on July 4.

The law curtails federal spending for renewable energy, cutting off a major funding source that many faith-based organizations have tapped to make their projects more affordable. Among the impacted projects are a multimillion dollar plan to put solar panels on schools throughout the Archdiocese of Los Angeles as well as the first solar installation on a school in a Florida diocese.

"It's just making projects more expensive," said Page Gravely, who heads the Catholic Climate Covenant's Catholic Energies program that assists church organizations on solar and other energy installations.

A piece of the "One, Big, Beautiful Bill Act," narrowly passed by the Republican-controlled Congress, effectively ends for now a Biden-era program called "direct pay" that for the first time allowed tax-exempt organizations and religious institutions to take advantage of clean energy tax credits through a cash payment received from the IRS. The tax credits reduce costs of an energy project through money coming back as a government payment.

U.S. House of Representatives Speaker Mike Johnson looks at U.S. President Donald Trump signing the sweeping spending and tax legislation, known as the "One Big Beautiful Bill Act," to mark Independence Day, at the White House in Washington, on July 4, 2025. (OSV News/Reuters/Leah Millis)

When the program first began in 2023, it was touted as a "game changer" for faith communities in particular, and delivered a long-time goal of faith organizations for federal assistance with energy projects. The U.S. Catholic bishops' conference for years has lobbied Congress for such financial support.

The credits Congress has now eliminated would reduce the costs of clean energy investments like solar arrays, wind farms, battery storage and geothermal systems by at least 30%. The savings could have risen to as much as half the cost of the project if it meets other factors, such as using union labor or building in a low-income area.

At Sacred Heart Catholic Church, in northern Omaha, the parish completed two solar projects in the past 18 months that still qualified for the tax credits. It expects to receive cash payments of $18,000 for the 24-kilowatt system ($45,000 cost) on its office building and $70,500 for the 70-kilowatt solar array that cost $235,000 to install at the parish school.

"We could not have afforded that without the direct pay program," pastor Fr. David Korth said.

While President Donald Trump's new law leaves the direct pay program untouched, the tax credits for solar and wind developments are now only available for projects that begin construction within one year of the bill's enactment; all other projects must be placed in service by the end of 2027. Other projects like geothermal and battery storage must begin construction by the end of 2033.

The law also places new restrictions on the tax credits, for instance, barring materials for clean energy projects from "prohibited foreign entities," which widely refers to China.

The actions by Congress come even as nearly 60% of clean energy spending from the Inflation Reduction Act has occurred in Republican-held congressional districts.

The dismantling of federal climate policies follows Trump's second withdrawal from the Paris Agreement and other efforts by his administration to wipe out climate and environmental programs.

The Republican legislation "is a very, very bad bill for clean energy," said Jack Pratt, senior political director with the Environmental Defense Fund.

Religious groups urged to act fast or lose funding

Pratt said the law is especially a blow for religious organizations and nonprofits looking at energy upgrades for moral and economic reasons but may lack funds for expensive upfront costs.

"If you're a smaller entity, then you really are reliant on these incentives to help you overcome that first hurdle, even for something that's paid off over several years," Pratt said.

As it followed the legislation's developments, Catholic Energies encouraged church organizations considering solar to make decisions in the next 90 days in order to utilize the federal energy credits.

"There is a sense of urgency," Gravely said. "We're just telling clients that you got to act if you're really serious about solar and you want to optimize" a project's finances with the federal energy credits.

Visitors to the U.S. Capitol rest in the shade on Capitol Hill in Washington on June 25, 2025. (OSV News/Reuters/Nathan Howard)

Since nonprofits received access to the tax credits in 2023, roughly half of Catholic Energies' clients have opted to utilize them to reduce costs of clean energy projects. Often, those savings not only have helped lower bills but have allowed churches and schools to redirect more funds toward ministries serving their communities.

The Los Angeles Archdiocese is partnering with Catholic Energies for a multimillion dollar project that would initially install solar arrays at nearly two dozen of its 240 schools. The loss of federal energy credits is expected to result in millions of dollars less in energy cost savings that the archdiocese could otherwise reinvest in teachers and Catholic education.

Another Catholic Energies project in the works would construct the first solar installation for one Florida diocese, where the energy tax credits would reduce costs by at least $450,000. The savings available through federal incentives made the project's economics more attractive because Florida is one of at least six states that bars power purchase agreements, according to the Database of State Incentives for Renewables & Efficiency. In a power purchase agreement, a third-party developer pays for the solar array, while claiming any tax benefits, and then sells the power from the system to the customer, often at a lower, fixed rate.

The final text of Trump's domestic agenda law mostly took aim at tax incentives for solar and wind developments. An earlier draft in the House sought to eliminate all clean energy tax credits for all projects not under construction within 60 days of it becoming law, and requiring they be placed in service by the end of 2028.

At Sacred Heart Catholic Church, in northern Omaha, the parish completed two solar projects in the past 18 months that qualified for clean energy tax credits. It expects to receive cash payments of $18,000 for the 24-kilowatt system (that cost $45,000) on its office building and $70,500 for the 70-kilowatt solar array that cost $235,000 to install at the parish school. (Afton Energy)

Those terms could have spelled trouble for the Sisters of St. Benedict, who are in the process of constructing a 200-well geothermal system to heat and cool some of its oldest buildings at Monastery Immaculate Conception, in Ferdinand, Indiana.

The $10 million project, begun in 2024 and set to complete in 2026, was initially financed on their own through donors and a bank loan. The sisters said they planned to apply for the federal tax credit, which could save $3 million-$4 million. If the credit was lost, they would be forced to tap into savings set aside for the sisters' retirements.

In Omaha, Duchesne Academy of the Sacred Heart, an all-girls Catholic high school, has planned to apply for an energy tax credit to offset a portion of its own $2 million geothermal system that is set to finish construction in summer 2026.

"We're just trying to do the right thing for the world," Meg Brudney, Duchesne head of school, said.

An economic and moral loss

Before Trump signed the law July 4, Archbishop Timothy Broglio, the president of the U.S. bishops' conference, criticized its "devastating effects," including cuts to programs protecting God's creation.

"Vulnerable communities will be less prepared to cope with environmental impacts of pollution and extreme weather," he said in a July 3 statement.

Earlier, Broglio warned in a letter to Congress that the bill's clean energy and environmental cuts would harm both God's creation and future generations.

Another letter from bishops to senators also decried the reductions.

"Cuts will also lead to increased pollution that harms children and the unborn, stifles economic opportunity, and decreases resilience against extreme weather," the bishops wrote. "These changes will also discourage clean energy companies from investing in or continuing operations."

Advertisement

Members of Catholic Climate Covenant in late June delivered copies of Pope Francis' 2015 encyclical "Laudato Si', on Care for Our Common Home," to every Catholic member of Congress, including Sen. Lisa Murkowski of Alaska, who along with five other senators sought some protections of the energy tax credits in the bill.

It was from reading Laudato Si' a decade ago that Korth, the pastor at Sacred Heart and member of the Omaha Archdiocese's Laudato Si' commission, felt compelled to move to renewable power, but only if it made financial sense for his parish and school in one of Omaha's poorest zip codes, already facing a tight budget.

In April, he took part in a rally opposing the elimination of the clean energy tax credits. While projects at his parish are complete, the Omaha Archdiocese viewed the federal credits as a means of financing its own plans to expand solar power across its hundreds of buildings.

"All of that is really on hold," Korth said.